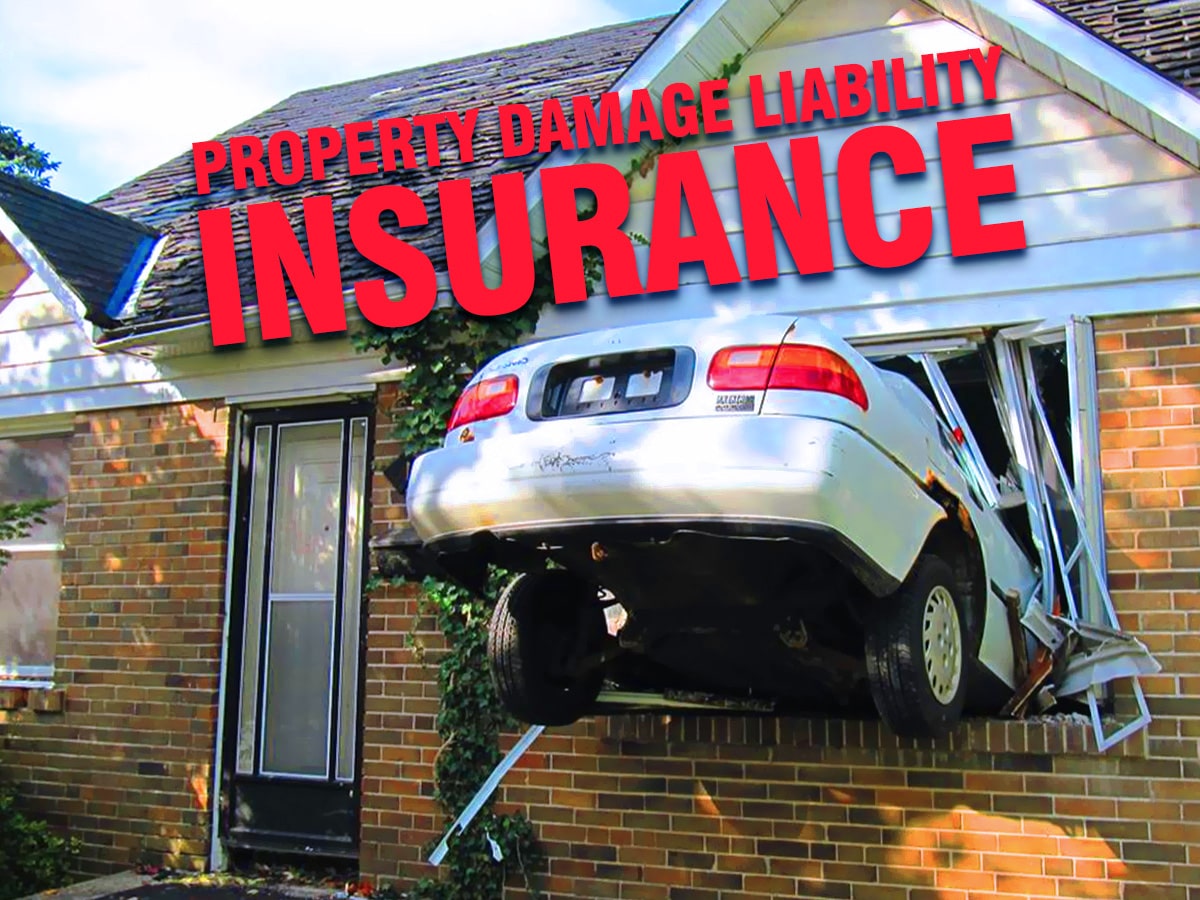

Property Damage Liability Insurance

Pretty much every state requires property damage liability insurance as part of its minimum limits, making it a necessary coverage to have to drive legally. Almost all types of insurance plans include property damage liability, as it covers the costs of repairing the damage that you cause to other people's property. This can consist of other people's vehicles. Having a solid knowledge about what property damage liability coverage does is essential, you will need to know how much insurance is right for your situation and how the insurance works.

How Does Property Damage Liability Insurance Work?

Property damage liability insurance, also called PDL, helps cover the cost of repairing damages to another person's property when it is the result of an automobile accident that is deemed to be your fault. This can include things like damaging someone's fence or mailbox. If these types of property, and others, are damaged because of you, your property damage liability insurance will cover the cost of repairing that property. Also, property damage liability provides coverage for you if you crash into someone's vehicle.

Property damage liability insurance does not, however, cover damages that are people related. If someone is injured because of you in an automobile accident, it does not cover their lost wages, medical bills, or other costs. Property damage liability insurance does not cover your lost wages, medical bills, or other costs either. Different types of coverages are available which cover these, such as bodily injury liability insurance or personal injury protection. You will want to make sure that you have all of the needed coverage to protect yourself from expensive situations that can stem from car accidents.

Check up on the minimum requirements for insurance in your state, most states require not only property damage liability insurance, but also bodily injury liability insurance as well. Some states require more types of insurance in addition to these, like uninsured motorist coverage and UIM coverage, among others.

What Does Property Damage Liability Insurance Cover?

PDL or property damage liability insurance covers the costs associated with repairing or replacing property that you damage while you are driving. If you are found to be at fault in an accident, your PDL plan will cover the costs of repairing or replacing the vehicle of the other driver.

Another thing that property damage liability insurance can cover his lawsuits. If someone sues you after an accident for damages, your PDL insurance coverage can cover the liabilities that stem from that lawsuit.

In its most basic sense, property damage liability covers damage to other vehicles and damage to other property. There is a list of things that property damage liability insurance does not cover, however.

What Does Property Damage Liability Insurance Not Cover?

Like many types of agreements, there are exceptions to the big picture. Property damage liability insurance does not cover all of the property damage and all accidents. The most prominent example of this is that PDL insurance will not cover damage to your own vehicle or your personal property. If you are found at fault in a collision, and property damage liability insurance is the only insurance you have, the damage to your car will be paid for by you out of your own pocket. If the other driver is at fault, then their PDL insurance should cover the damage to your vehicle after you make a claim.

Many people decide to get additional insurance, like comprehensive and collision insurance, to help cover the costs associated with damage to their vehicle. To reiterate, property damage liability insurance does not cover damage to your own car, damage to your personal property, lost wages, medical bills, and other similar expenses.

Lost wages, medical bills, and other similar expenses tend to fall under bodily injury liability insurance coverage. Damage to your own vehicle would fall under comprehensive coverage or collision insurance. Both comprehensive insurance and collision coverage are optional; you are not required to purchase them on your car, although some leasing and lending companies do require you to have it in the terms of your lease or loan.

Should I Get Property Damage Liability Insurance?

In every state in the country, except for New Hampshire, you are legally required to have property damage liability insurance if you are driving a vehicle. If you do not have this type of insurance, you are considered driving without insurance and are breaking the law. It is simply smart to have this type of insurance either way because it protects you from the potentially expensive bills that can come your way if you are in an automobile accident.

PDL insurance coverage is included on all basic liability auto insurance plans. It is entry-level insurance and required to drive legally.

How Much Property Damage Liability Insurance Should I Get?

Each person will have different needs regarding how much property damage liability insurance they can get. There is a required minimum amount for people to get for each state, and each state has different amounts. These amounts can range from $10,000 to $50,000 in coverage per accident. Often, drivers choose to get coverage that is higher than these minimums. If the minimum is $15,000 of property damage liability, and you total a car worth $60,000, you will be responsible for the difference. Consider also that multiple vehicles may be damaged in an accident that you are at fault for. These expenses can add up quickly and become quite overwhelming. Insurance helps.

How to Compare Property Damage Liability Insurance Quotes

Part of the free insurance quotes you get online include property damage liability. It is generally listed in its own section on your policy, making it easy to find and compare with other policies. This is the same spot that allows you to adjust your limits for this type of insurance. When comparing plans, you will want to compare similar amounts from multiple companies. To find the best rates, you will also want to compare customer service satisfaction and claims satisfaction when selecting your car insurance company.

How Do You File a Property Damage Liability Claim?

Filing a claim can be easy to do, and more companies than ever are allowing it to be done via mobile app. You will either need to file out an application from your mobile app, call your car insurance company, or speak to an agent in person in order to submit a claim. It is smart to have a police report available if the accident involves more than one person.